What is the Structure of the CFO Team?

The Chief Financial Officer (CFO) oversees any firm’s financial strategy, performance, and reporting. However, it is not feasible for them to work alone. If that’s the case, then what is the structure of the CFO team?

CFOs also need the help of a committed staff to ensure that the finance department runs well. Working in isolation might reduce the work’s quality. Therefore, L&Y Tax Advisor helps you learn what is the structure of the CFO team so you can understand the organization of financial leadership in a firm.

Key Members of a CFO Team

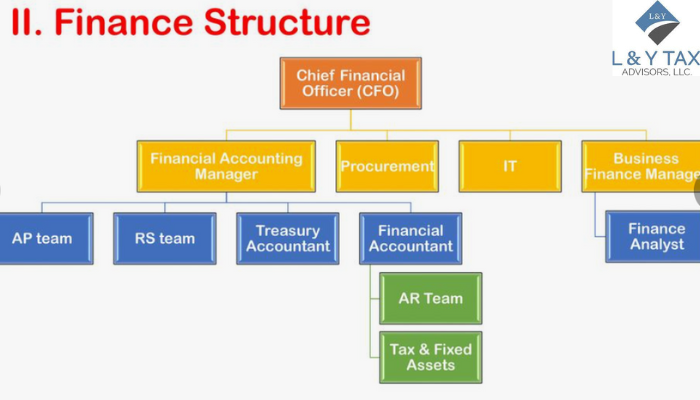

The CFO team’s organizational structure is usually created to assist the CFO in managing planning, compliance, and financial operations. The following are the primary responsibilities often seen in the team:

Controller

The controller is in charge of overseeing the business’s accounting procedures. This includes:

- Administering internal controls

- Creating financial statements

- Supervising financial reporting

The controller ensures that the business’s financial operations adhere to internal and regulatory guidelines.

Go through our CFO & business advisory services.

Treasurer

The treasurer is in charge of overseeing the business’s cash flow, investments, and risk management. Their responsibility is to guarantee that the firm maintains ideal liquidity levels and makes wise investment choices. Along with managing banking connections, the treasurer works closely with the CFO to mitigate financial risk.

Head of Financial Planning and Analysis (FP&A)

Analyzing financial performance and predicting future financial trends are essential for the FP&A. CFO and the head of FP&A:

- Creates budgets

- Tracks financial performance using necessary measures

- Offers valuable information to modify strategic choices

Read: What is a VAT number in the US?

Tax Manager

The tax manager ensures the company complies with national and international tax laws. In addition to creating reports and handling tax filings, their duties also include implementing tax plans that reduce obligations while maintaining compliance.

Internal Auditor

Internal auditors evaluate the effectiveness of internal controls and ensure that financial procedures follow regulations and organizational norms. This position is essential to maintaining openness in the financial department and combating fraud.

Supportive Functions

In addition to these critical positions, the CFO team often consists of:

- Financial analysts

- Payroll experts

- Managers of accounts payable and receivable

These positions guarantee that all transactions are handled correctly and quickly while supporting daily financial activities.

Why a Well-crafted CFO Team is Important in Business Expansion

An effectively developed CFO team is not merely a backup mechanism, but it is directly involved in helping a company to succeed over a long period. By having the right financial experts collaborate under the leadership of the CFO, there is greater oversight of the business, quicker decision-making, and financial health is greater. All the functions of the team make sure that all the necessary financial activities, including compliance with forecasting, are handled accurately and efficiently.

Strategic planning is also made strong with a strong CFO team. With real-time financial visibility, CFOs can steer the company through expansions, acquisitions, fundraising choices , and cost reduction programmes. The team’s make-up engenders transparency and accountability, which builds trust with all relevant stakeholders, investors, and regulators.

Furthermore, a disciplined finance function can serve in the control of risks and protection from fraud or financial misstatement, as well as the liquidity difficulties of the company. With the expansion of business, the complexity of finances arises, and the structure of a CFO team is needed to manage the operations of a growing business without jeopardizing the financial aspects. Finally, the knowledge of this structure allows companies to be smarter and more assertive in a competitive market.

Read more: What is Capital Work in Progress?

The Bottom Line

Comprehending what is the structure of the CFO team is intended to encompass every facet of financial management. Every function enhances the organization’s economic well-being, freeing the CFO to concentrate on strategic leadership.

Contact our tax consultancy services for the best taxation and financial assistance in the US.