Is Overtime Taxed More?

Many people in today’s fast-paced work environment work extra hours to meet deadlines or attain personal objectives. However, a typical issue arises when the hours pile up: Is overtime taxed more?

Let’s look at this often-misunderstood component of income and taxation to alleviate the worries regarding employment and monthly earnings.

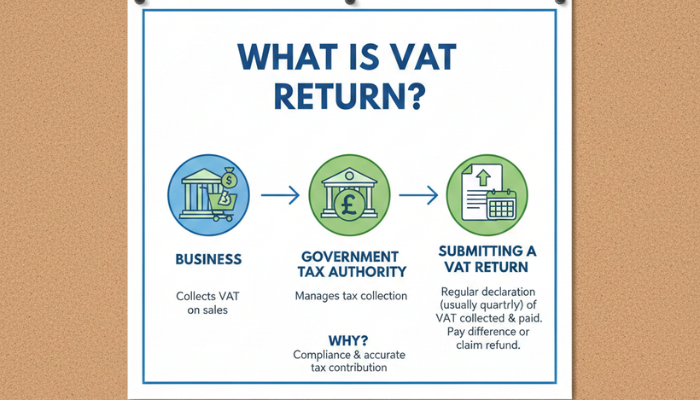

Overtime and Taxation Fundamentals

Before revealing, ‘Is overtime taxed more?’, you must understand the fundamental concept of overtime.

The additional compensation employees receive for working beyond their regular hours is known as overtime pay. This extra pay is taxed similarly to typical wages. In any case, it is fundamental to note that extra-time pay is charged at a similar rate as average pay and is determined by your individualized tax bracket.

Overtime Earnings and Marginal Tax Rates

The question, ‘Is overtime taxed more?’ originates from a misunderstanding of how marginal tax rates work. Our tax advisor services are a great help in this regard.

Most countries, including the US, have an ever-evolving charge framework in which expense rates move as pay levels rise. It implies that individuals may be pushed into paying a higher tax rate due to rising earnings, creating the impression that they are taxed more heavily over time.

The Effect on Tax Brackets

When somebody works overtime, the extra earnings may cause them to have a higher tax rate. However, only profits over the threshold for that bracket are taxed at a higher rate, not all earnings. It’s critical to remember that the tax rate only applies to the percentage of your income that falls within that certain bracket, not your total income.

Withholding and Deductions

Overtime earnings also affect how much tax is deducted from each paycheck. Because of the larger income for the pay period, additional taxes may be withheld at the start. However, any extra withholding will be returned upon tax filing if the taxpayer does not owe additional taxes. Understanding and changing withholdings can aid in the efficient management of this component.

Overtime Earnings Tax Strategies

Several ways can be used to reduce the tax burden of overtime earnings. Contributing to retirement funds, such as a 401(k) or an IRA (Individual Retirement Account), can reduce taxable income, possibly reducing the impact of shifting into a higher tax rate.

Furthermore, investigating possible tax deductions or credits helps mitigate the tax effects of overtime compensation.

Considerations for State and Local Taxes

Overtime earnings may also be taxed differently depending on state and local tax regulations. Some states have flat income tax rates, while others, like the federal government, have a progressive tax structure. Understanding regional tax legislation is critical to appropriately analyzing time’s influence on overall taxes.

New Federal Deduction for Overtime Pay

Starting in tax year 2025, the federal law One Big Beautiful Bill Act introduces a new above-the-line deduction for “qualified overtime compensation” due to wage earners subject to the Fair Labor Standards Act rules.

Under this provision, eligible single filers may deduct up to $12,500 and married joint filers up to $25,000 of overtime pay earned in excess of the regular rate, with phase-outs beginning at modified adjusted gross incomes of $150,000 for singles and $300,000 for joint filers.

Importantly, while federal income tax may be reduced, overtime earnings remain subject to Social Security and Medicare (FICA) taxes. They may still be taxed at the state or local level.

Employer and Payroll Implications

For employers and payroll administrators, the key takeaway is that withholding on overtime pay continues as usual in 2025, because the new deduction impacts federal income tax at filing rather than automatic payroll withholding.

Employers should start tracking “qualified overtime compensation” separately and expect forthcoming IRS guidance on W-2 reporting (likely a new box or annotation) and potential updates to Form W-4 withholding tables by 2026.

While this deduction will benefit many hourly workers who excel beyond base pay, it applies only to a subset of taxpayers – studies estimate fewer than 10 % of filers will qualify – so individual tax-planning remains essential.

The Bottom Line

Summarizing the debate on ‘Is overtime taxed more?’, it is concluded that while overtime earnings are taxed, they are not taxed at a greater rate than regular wages. The impact of increasing income on tax rates and withholding frequently causes this mistake.

Understanding the complexities of taxation and utilizing intelligent financial planning can assist you in more successfully navigating the ramifications of overtime earnings. Always seek the opinion of our best tax consultant Houston for specialized advice tailored to your specific circumstances.