What is the Sales Day Book?

Preserving precise documentation of monetary transactions is crucial in the rigorous field of accountancy. The sales day book becomes an essential instrument for credit sales recording for companies that use manual accounting systems. But what is the sales day book, and how does it work?

An Insight into Sales Day Book

All credit sales made by a corporation are chronologically documented in a sales day book. It is commonly referred to as a sales journal or sales book. The general ledger is the central database that contains all financial transactions. It receives information from it as a subsidiary book.

What is Included in a Sales Journal?

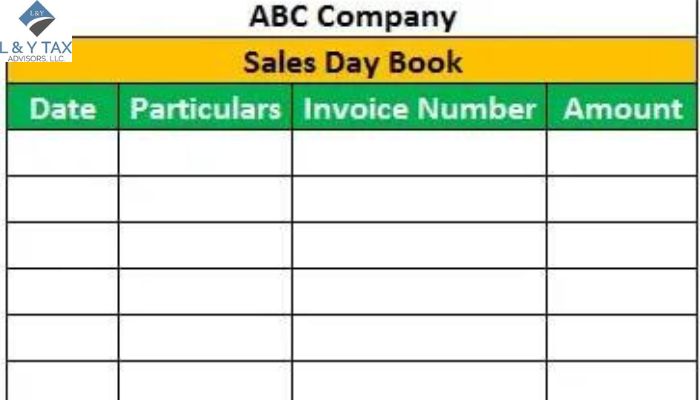

A typical sales book comprises:

- Date: The day of the credit sale.

- Customer Name: The person who used credit to buy products.

- Invoice Number: A unique number linked to the sales invoice sent to the client. The invoice date is the day the sales invoice was produced.

The invoice amount is the whole credit sale amount, less applicable trade reductions.

Pay Special Attention to Credit Sales

It is crucial to remember that credit sales are the only transactions recorded in the sales day book. In cash sales, payments are made at the moment of purchase. These are noted in a different ledger, which is sometimes called the cash book.

This division guarantees a precise separation between immediate and overdue payments while streamlining record-keeping.

Advantages of Maintaining a Sales Day Book

The sales day book provides several benefits to companies that haven’t switched to digital accounting systems.

Streamlined Record-Keeping

The sales day book keeps a clean, chronological record by consolidating credit sales data into a single volume. It makes it simple to access previous transactions.

Improved Efficiency

Having a separate record for credit sales expedites the posting procedure to the general ledger. By transferring totals straight from the sales day book, mistakes can be reduced, and time can be saved.

In-depth Sales Analysis

Cash book entries sometimes lack the degree of information provided by the sales day book. By examining client names and invoice amounts, businesses may obtain important insights about sales patterns and consumer behavior.

Click here to get our QuickBooks & Bookkeeping services.

The Evolution of the Sales Day Book

Accounting software has largely replaced manual bookkeeping procedures in the current digital era. Thanks to software programs that automatically record and capture sales transactions, there is no longer a need for a paper sales day book.

Improved Precision with Digital Integration

By using a digital strategy for the Sales Day Book, businesses may gain real-time information and drastically reduce human mistakes. In addition to streamlining everyday tasks, automated input and computation tools reduce transcription errors and data loss, which are frequent problems with conventional paper ledger techniques.

In fact, digital solutions provide encrypted, centralized storage that improves security and accessibility. They also drastically reduce processing costs (about $15 per invoice when done by hand versus $2 when done digitally).

As a consequence, businesses are able to provide precise sales reports on demand and react quickly to cash flow patterns, which enhances stakeholder confidence during audits and monetary assessments and supports operational agility.

Read: What is the difference between control account and general ledger?

Increase Compliance with Automated Tax Procedures

Using technology to handle the Sales Day Book also promotes strong tax compliance. Automated tax-rate systems apply real-time jurisdictional rules, reducing the possibility of under- or over-collection of sales tax and the associated fines.

Integration with accounting platforms guarantees correct transaction classification and audit-ready documentation. By automating repetitive activities, this cooperation not only protects firms during regulatory scrutiny but also saves critical time.

Adopting digital solutions improves financial integrity, grows with the company effectively, and turns compliance from a liability into a competitive advantage.

The Bottom Line

Learning what is the sales day book reveals a historical cornerstone that provides insightful information about the development of credit sales tracking and management practices in business, regardless of experience level in accounting. Conceiving the intent and operation of the sales book is helpful for individuals looking for a thorough grasp of conventional accounting techniques.