Does IRS Send Refund Before Deposit Date?

In the world of tax returns and refunds, the timing of obtaining a refund is frequently a source of excitement and interest. The Internal Revenue Service (IRS) is responsible for administering and distributing tax refunds to qualified taxpayers. However, does IRS send refund before deposit date?

Let’s take a closer look at this aspect of tax refunds to acquire a better understanding.

The Refunding Procedure

The IRS usually issues refunds on a set schedule. However, a variety of events might affect when the return arrives. The IRS begins processing a tax return after filing and approval. This stage entails checking the information given and computing the refund amount payable to the taxpayer. In case of any difficulty, we commend you for availing tax advisor services as soon as possible to avoid further delays.

Date of Deposit and Expectations

Finding the answer to ‘Does IRS send refund before deposit date?’ is essential because when taxpayers check their refund status, they frequently get a deposit date. This date estimates when the refund will be placed into their bank account or sent to them.

However, it is essential to remember that the deposit date does not ensure that the cash will be accessible on that day.

Does IRS Send Refund Before Deposit Date?

While the IRS strives to adhere to the stated deposit date, there are times when refunds arrive sooner than expected. This early delivery might be attributable to various causes, including rapid processing, the simplicity of the tax return, or other internal IRS variables.

Early Refund Influencing Factors

Several variables contribute to the chance of receiving a refund before the deposit date. For instance, if a tax return is primary and does not require further examination or information, the processing time might be shortened, resulting in an early refund.

Furthermore, using electronic filing and direct deposit as the refund option speeds up the process, resulting in refunds coming sooner than intended. These situations, however, might differ for each taxpayer depending on their circumstances and the intricacy of their tax return.

Controlling Expectations

While getting a refund before the deposit date is possible, taxpayers must cope with their expectations. The specified deposit date serves as a guideline. However, unforeseen events or an IRS backlog can occasionally cause refunds to be delayed.

Patience and Persistence

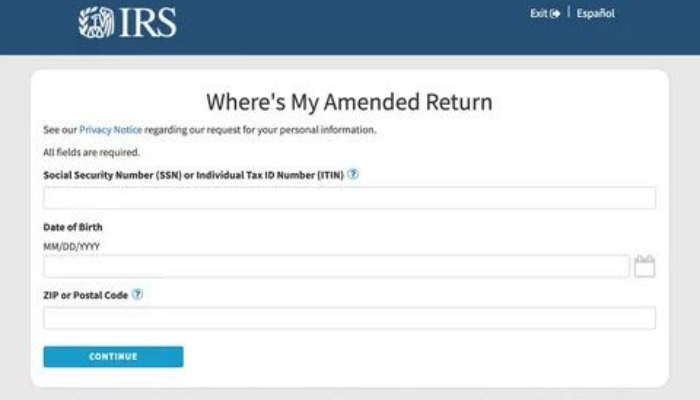

Taxpayers can use the IRS’s online resources to follow the status of their return to remain up to date. Individuals may track their recovery status by using the IRS’s ‘Where’s my return?’ feature. It updates whether it has been processed, authorized, or scheduled for deposit.

The Bottom Line

Finalizing the discussion on ‘Does IRS send refund before deposit date?’, it is concluded that the IRS makes every effort to adhere to the deposit dates specified to taxpayers when they file their forms. While refunds may arrive sooner than expected owing to quick processing or easier tax conditions, our best tax consultant Houston specialists recommend that you keep reasonable expectations regarding the arrival schedule. Using the available tools to track the refund status can help people keep informed and plan for the arrival of their reimbursements.