What is a Sales Tax Invoice?

Understanding what is a sales tax invoice is paramount, as it is a cornerstone in the maze of financial documents. It is more than just a piece of paper or a digital record; it is a vital document that captures the essence of a transaction, particularly in trade and business.

Our best tax consultant Houston services presents further details for you to navigate the complexities of this essential piece of documentation.

Creating a Sales Tax Invoice

A sales tax invoice is a legal document a seller delivers to a customer that details the items or services supplied, their relative costs, relevant taxes, and other essential information. This invoice is proof of a transaction and is necessary for financial records and tax-related problems.

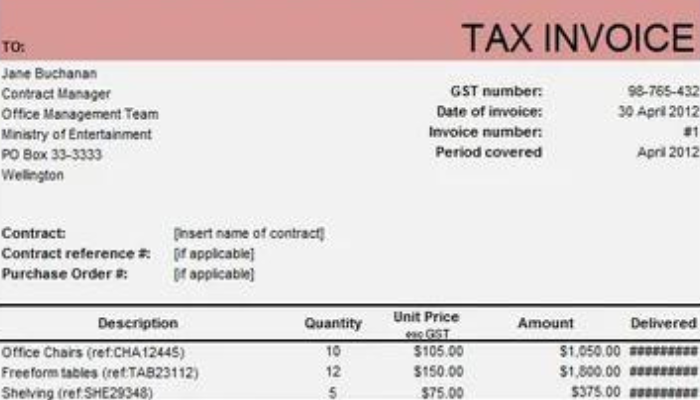

Identification Information

A sales tax invoice normally contains information identifying the vendor and the customer. Names, residences, contact information, and, in certain cases, tax identification numbers are included.

Invoice Number and Date

Each invoice is granted a unique identity for tracking purposes. It also specifies the date of issuance, which helps preserve chronological records.

Goods or Services Description

A detailed analysis of the products or services sold, including quantities, unit pricing, and a total sum for each line item.

Tax Information

The invoice must include the appropriate sales or other taxes. This section specifies the tax rates used and the resulting amounts.

Terms of Payment and Total Amount Due

The invoice describes the entire amount due by the buyer to the seller and provides the agreed-upon payment arrangements.

Importance and Legal Consequences

Understanding what is a sales tax invoice is more than simply a transactional record; it is legally binding. Tax authorities frequently request firms to check the correctness of their tax filings. Failure to keep correct invoices and errors in these papers might result in financial penalties or legal ramifications.

Sales Tax Invoice Variations

Different areas or nations may have additional sales tax invoice requirements or forms. In certain locations, for example, invoices must include precise information or adhere to specified designs mandated by tax legislation.

Importance for Businesses and Customers

Businesses must issue correct sales tax invoices to keep clear financial records, ensure compliance with tax rules, and facilitate easy audits. For consumers, these invoices serve as evidence of purchase, providing security in case of a dispute, return, or warranty claim.

Automation and Digitalization

Electronic counterparts are rapidly replacing traditional paper-based invoices due to the digital revolution. Automated solutions simplify invoicing, decreasing mistakes and increasing efficiency for vendors and purchasers.

Sales Tax Invoice Best Practices

Ensure that all facts, from item descriptions to tax amounts, are accurate and error-free.

Compliance with Regulations

Stay current on local tax rules and regulations to prepare invoices that meet legal standards.

Record-Keeping

Maintain a systematic strategy for saving and categorizing invoices for simple retrieval and auditing.

Technology Adoption

Use digital invoicing solutions to improve the process and reduce human mistakes.

The Bottom Line

Understanding what is a sales tax invoice appears as a vital thread in the fabric of company operations, weaving together legal, financial, and transactional factors. Its value extends beyond a simple receipt; it represents openness, compliance, and documentation and plays an important part in the commercial environment. Understanding its subtleties and significance is critical, and we recommend you seek our experienced and reliable tax advisor services for your organizations and consumers navigating the complex web of transactions and laws.