What is Account Payable Meaning?

The terminology ‘account payable’ is vital in finance and business management. But what is account payable meaning?

An Account payable is your company’s outstanding bills to suppliers or vendors for goods and services received (but not yet paid). These liabilities are brief commitments or debts. You must pay them off in a specified period, usually a year.

Why is it Called Accounts Payable?

Account payable is called so because it refers to all your business payments except payrolls. It is essential to preserving your company’s financial stability and operational effectiveness.

If your firm manages its accounts payable well, you can:

- Benefit from early payment discounts

- Avoid late payment penalties

- Have positive working relationships with your suppliers

Critical Components of Account Payable

Now that you know what is account payable meaning, let’s study its components:

Invoices

Suppliers provide detailed bills called invoices. They include a description of the following:

- Goods or services they have given

- How much do they cost

- How much totaling

- Other related information

Payment Terms

These specify when the money must be paid. Terms that determine how many days the business has to pay the invoice, such as:

- Net 30

- Net 60

- Net 90

Purchase Orders

These are official corporate papers. They outline the goods or services needed and are sent to suppliers. As a point of reference, they help confirm the specifics of the invoice.

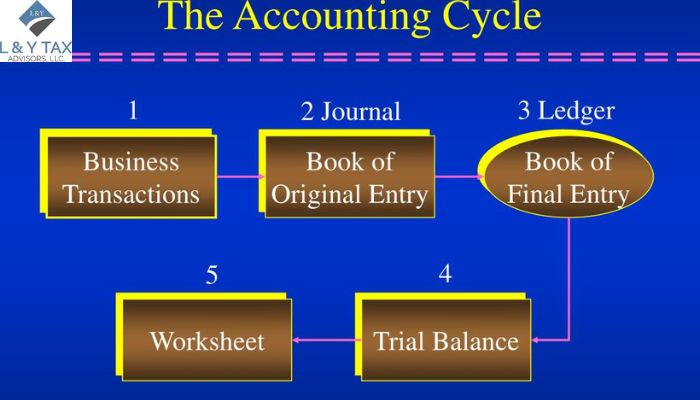

The Account Payable Process

Several phases are involved in the account payment process to guarantee timeliness and accuracy:

Receipt of Invoice

The procedure starts when the business gets an invoice from the supplier.

Verification

The purchase order and the actual receipt of the products or services are compared to the invoice’s information.

Approval

The relevant staff members within the company authorize the invoice for payment once it has been confirmed.

Recording

The accepted invoice is entered as an account payable in the business’s accounting system.

Payment

The last phase uses credit cards, electronic transfers, cheques, or other approved payment methods to pay the invoice within the specified timeframes.

Importance of Managing Account Payable

Account payable has to be managed well for several reasons.

Cash Flow Management

Ensuring the business can fulfill its other financial responsibilities requires maintaining a healthy cash flow facilitated by properly scheduling payments.

Credit Rating

Making on-time payments contributes to a positive credit rating, which is advantageous for negotiating favorable conditions with suppliers and getting financing.

Supplier Relationship

Good ties with suppliers may result in increased terms, better service, and discounts.

Click here to get our QuickBooks & Bookkeeping services.

Best Practices for Account Payable Management

By automating the accounts payable process with accounting software, mistakes may be decreased, and productivity can be raised.

Regular Reconciliation

It is helpful to find and quickly address inconsistencies when accounts payable, and supplier statements are regularly reconciled.

Monitor Metrics

Monitoring essential performance metrics, such as days payable outstanding (DPO), can reveal how well the payables process works.

The Bottom Line

Comprehending what is account payable meaning helps you preserve financial stability and promote growth. It is also essential to understand how it functions in corporate operations. Use of optimal methodologies and effective managerial techniques. It will help you guarantee that your accounts payable procedures have a constructive impact on your overall monetary well-being.