What is NTN and GST?

Do you know what is NTN and GST? NTN (National Tax Number) and GST (Goods and Services Tax) are two vital terminologies that frequently arise when discussing taxes and company compliance.

Businesses and people engaged in international commerce or taxes must comprehend NTN and GST, their applicability, and their importance in the United States.

Why Does Understanding NTN and GST Matter for US Businesses?

Comprehending what is NTN and GST in the US is essential for companies doing business abroad because it:

- Guarantees adherence to international tax laws.

- Assists in navigating tax laws and import/export paperwork.

Read: YMCA tax exempt.

What is NTN in the US?

National Tax Number (NTN) is mainly used in countries like Pakistan. It serves as a taxpayer’s unique identification number. A similar notion is implemented in the United States. Instead of NTN, Employer Identification Number (EIN) or Taxpayer Identification Number (TIN) are used in the US.

Get your VAT number USA.

What is the Purpose of NTN Equivalent (TIN/EIN)?

The purpose of TIN or EIN is to:

- Process filings

- Keep track of tax obligations

- Make it easier to comply with state and federal tax laws.

As a TIN, people usually use their Social Security Number (SSN).

The IRS assigns businesses an EIN, which is a nine-digit identification number.

Key Features of TIN/EIN

- Permits tax compliance and reporting.

- Needed for submitting tax returns.

- Required for recruiting staff.

- Helps in creating company accounts.

Get our tax consultancy services for taxation and financial assistance.

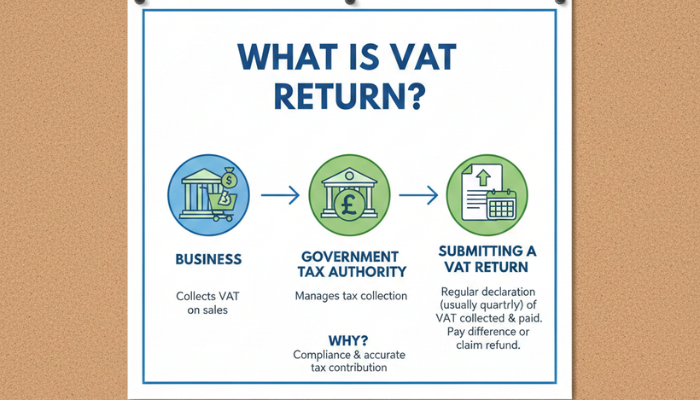

What is GST in the US?

The Goods and Services Tax (GST) is a value-added tax frequently imposed in countries including Australia, Canada, and India. There is no federal GST system in the United States; instead, it depends on sales tax, which differs from state to state.

How Does Sales Tax Work?

Sales tax is levied on products and services at the time of sale. Every state determines its tax rate. Certain municipal governments can also levy extra fees.

Read about financial reporting and analysis.

What is the Difference Between GST and US Sales Tax?

The US collects sales tax at a single location (the retail purchase), while GST is a single, multi-stage tax system.

Sales tax rates vary significantly between states and even localities. In contrast, GST is applied consistently throughout the nation.

The Bottom Line

Learning what is NTN and GST is essential because these terms are not used in the US. Businesses must stay compliant in a world that is becoming more linked by knowing the differences between their international counterparts and their US equivalents, TIN/EIN, and sales tax. Maintaining awareness and consulting L&Y Tax Advisor professionals guarantees smooth operations and compliance with legal requirements.