What is the 5 Step Accounting Cycle?

Have you wondered what is the 5 step accounting cycle? Well, who knew you’d be able to manage your business’ monies in a cyclic manner!

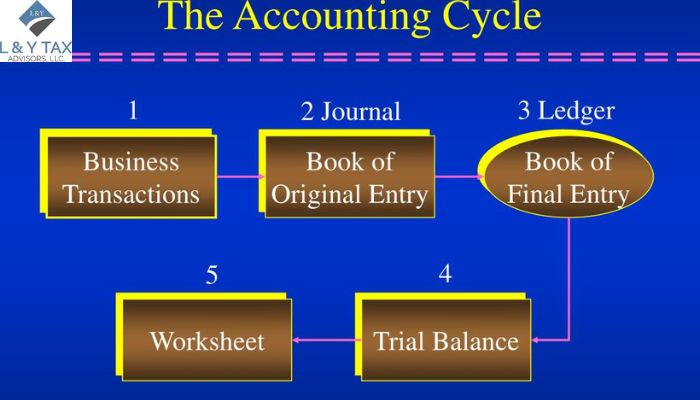

The five-step accounting cycle is an essential procedure for guaranteeing the correct documentation and reporting of your company’s financial activities.

To ensure financial integrity and accurately prepare financial statements, this methodical process is mandatory. Please keep reading to explore each phase of the accounting cycle and its importance.

Step 1: Identify and Analyze Transactions

Recognizing and evaluating every financial transaction is the first stage of the accounting process. To guarantee that every transaction is recorded, review source documents such as:

- Contracts

- Bank accounts

- Invoices

- Receipts

Recognize the type of transaction, whether it is a sale, buy, payment, or receipt. You will learn how it affects the financial accounts. Accurate identification and analysis will make this easier.

Step 2: Record Transactions in the Journal

Accurate transaction journaling is necessary to have trustworthy financial records. Transactions must be entered into the journal when recognized and examined—this process of journalizing. Double-entry accounting sequentially records transactions, with each entry consisting of a debit and a credit.

By doing this, the accounting formula is kept in balance – the formula is:

Assets = Liabilities + Equity

Step 3: Post Transactions to the Ledger

Posting the transactions to the general ledger comes next after journalizing. A group of accounts called the ‘ledger’ is used to organize and compile journal entries for each transaction.

The posting process entails moving the credit and debit amounts from journal entries to the corresponding ledger accounts. This phase facilitates transaction organization and offers a clear picture of each account’s balance.

Step 4: Prepare an Unadjusted Trial Balance

A trial balance, a crucial tool in accounting, is generated after every transaction has been posted to the ledger. It presents all the ledger accounts and their current amounts as of that particular day, providing a snapshot of the financial status.

To validate the accuracy of the ledger entries, the trial balance checks that total debits and total credits are equal. Errors must be corrected before proceeding if there are any variances.

Step 5: Make Adjusting Entries and Prepare Financial Statements

The final step is to adjust entries to reflect accumulated and deferred items. It guarantees that all expenses and revenues are documented within the relevant accounting timeframe.

Posting and journaling adjustments are made to the ledger. Once modifications are made, an updated trial balance is created. This adjusted trial balance is used to create financial statements. These records give a thorough picture of your company’s financial situation, including:

- Income statement

- Balance sheet

- Cash flow statement

The 5 step of accounting cycle is a systematic process essential for maintaining accurate financial records. It begins with analyzing transactions and identifying and recording economic activities like sales and expenses. Next, journal entries document these transactions chronologically. These entries are then posted to the ledger, summarising each account’s balances. The trial balance step follows, where debits and credits are checked for accuracy. Finally, financial statements are prepared, clearly showing the company’s financial performance and position. Understanding these 5 steps of accounting cycle is vital for accurate and reliable financial reporting.

What are the 5 statements in accounting?

The five key financial statements in accounting are:

- Income Statement: Also called the Profit and Loss Statement, it indicates an organization’s revenues, charges, and earnings over a particular period. It allows for examining the organization’s profitability.

- Balance Sheet: This assertion affords a photograph of a corporation’s property, liabilities, and shareholders’ fairness at a particular factor in time. It follows the accounting equation: Assets = Liabilities + Equity.

- Cash Flow Statement: This statement tracks the glide of cash into and out of the business over a length. It is split into 3 sections: operating, investing, and financing sports.

- Statement of Retained Earnings: This assertion indicates the changes in retained earnings over a period, including internet profits and dividends paid to shareholders.

- Statement of Comprehensive Income: This assertion consists of all changes in equity from non-owner assets, together with unrealized profits or losses, and is commonly provided along the income declaration.

These 5 statements completely depict an employer’s financial fitness, performance, and cash flow.

Considerations for Managing Risks and Internal Controls

Accurate financial statements are only one of the many benefits of the five-step accounting cycle . It also forms the basis of strong internal controls and helps reduce risk. Adherence to procedures establishes checkpoints that aid in the detection of irregularities. These procedures include:

- Identifying transactions

- Accurately recording journal entries

- Publishing to the ledger

- Verifying trial-balance

- Modifying entries

This control makes sure that the accounting system gives management early warning signs so that they can take preventative measures. To further fortify defenses against mistakes and abuse of assets, division of tasks throughout these five processes is recommended.

Utilization of Technology and Ongoing Development

Automated technologies and continuous improvement approaches may greatly improve the five-step accounting cycle in modern accounting systems.

To speed up processes and decrease human error, software tools may automate tasks like:

- Transaction recording

- Validation of journal entries

- Ledger posting

Examples of such systems include enterprise resource planning (ERP) platforms and cloud-based accounting suites.

Analytics dashboards, however, make it possible to keep an eye on irregularities in the trial balance or patterns of adjustments to inputs in real time. Organizations should regularly examine their accounting cycle to:

- Optimize operations

- Enhance financial closure time

- Guarantee compliance with developing standards

This evaluation should seek out bottlenecks, unnecessary procedures, or training shortages. Maintaining the cycle’s efficiency as it grows requires constant input, which encourages flexibility.

Takeaways to Accelerate and Enhance Your 5-Step Accounting Cycle

By shortening the time to complete the five-step accounting cycle, decisions can be made more quickly and with less risk.

- The key is for organizations to standardize the source documents and to use digital routing (invoices, receipts, contracts) so that they don’t lose paperwork.

- Automate routine work; your bank feeds, recurring journal entries, and reconciliations so that staff can concentrate on the exceptions and on analysis.

- Have a short month-end checklist including reconciliations, accruals, review of exceptions, and sign-offs by the manager as well for accountability.

- Routinely review trends on adjusting entries to identify any process gaps or continuing education needs.

- Maintain a clear document-retention policy and one chart of accounts to enhance reporting.

- Finally, schedule quarterly “health checks” to benchmark close times, error rates, and control effectiveness; apply those insights to continue refining workflows.

More importantly, these pragmatic measures shore up controls to accelerate the financial close and deliver more timely and accurate financials. Read our complete guide on Tax Advisors vs CPA here!

The Bottom Line

So, now you’ve mastered what is the 5 step accounting cycle!

This cycle helps keep correct records and generate trustworthy financial accounts. L&Y Tax Advisor also help you make decisions. Carefully following these processes guarantees compliance with your accounting standards and financial correctness.

Click here to get our:

QuickBooks & Bookkeeping services.

Frequently Asked Questions (FAQs)

What is the primary difference between a 5-step and an 8-step accounting cycle?

Primarily, the difference lies in the level of detail and the grouping of tasks.

An 8-step cycle breaks down the ‘end-of-period’ phase into more granular actions. It specifically separates the

- Unadjusted trial balance

- Worksheet analysis

- Preparation of an adjusted trial balance

The 5-step cycle is a streamlined version. Many small businesses or within automated accounting software users utilize it. This cycle consolidates these technical sub-steps into broader categories like ‘Adjustments’ and ‘Financial Reporting.’

Can the 5-step accounting cycle be fully automated with software?

Accounting software (like QuickBooks) can automate much of the recording and posting (Steps 2 and 3) and generate financial statements (Step 5). But, the first step (identifying and analyzing transactions) needs human oversight. Professional accountants must ensure that source documents are correctly interpreted. The non-routine adjusting entries, such as depreciation or accruals, should also be accurately entered before the books are closed.

How often should a business complete the 5-step accounting cycle?

The frequency of the cycle depends on the reporting needs of the business. The ‘fiscal year’ is the most common full cycle. But, the most professional firms recommend a monthly cycle. Monthly completion allows business owners to:

- Review timely financial statements

- Catch errors early during the reconciliation phase

- Make data-driven decisions (based on current cash flow instead of waiting until year-end.)

Why is the ‘Adjusting Entries’ step critical for accrual-basis accounting?

In accrual accounting, revenue and expenses must be recorded when they are earned or incurred, regardless of when cash changes hands. Adjusting entries ensure that your budgetary statements comply with the ‘Matching Principle.’ Without this step, your profit-and-loss statement may show inflated or deflated earnings if a large payment was received for services that have not been fully delivered yet.

What happens if an error is discovered after the cycle is closed?

Once the books are closed, the temporary accounts (revenue and expenses) are zeroed out to Retained Earnings. If a material error is found after this point, it cannot simply be deleted. Instead, a ‘prior period adjustment’ must be made. This involves recording a journal entry in the current period to correct the beginning balance of Retained Earnings, ensuring the integrity of the historical financial data remains intact.