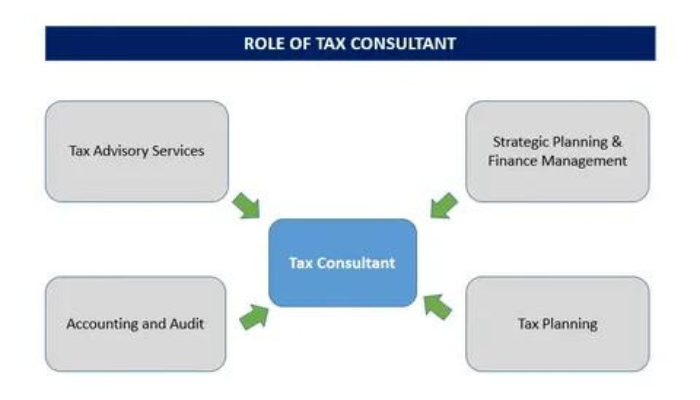

What is the Role of a Tax Advisory Consultant?

Individuals and corporations alike frequently find themselves navigating the convoluted landscape of taxes amid the complex web of finances and rules. In the midst of this maze, a guiding light appears in the shape of a tax advising consultant who provides important experience and help. For this purpose, it is essential to recognize what is the role of a tax advisory consultant.

Tax consulting services are an efficient navigator through the perplexing world of taxation. These specialists contribute a lot of expertise and experience to people, corporations, and organizations seeking clarity and strategic direction in tax-related concerns.

Knowledge and Insight Tax Advisory

A tax advice consultant’s principal responsibility is to give expert insight into continuously changing tax rules and regulations. They stay up to date on tax law changes, ensuring that their customers remain compliant while improving their financial strategy. It involves advising clients on tax planning, deductions, credits, and incentives provided under the law.

Customized Strategies

Every client’s tax position is unique, and a tax advisor is aware of this fact. They painstakingly evaluate their clients’ financial landscapes, discovering possibilities and developing tailored tax plans. These techniques seek to reduce tax payments, increase savings, and optimize financial resources in accordance with the client’s short- and long-term objectives.

Managing Complicated Situations

The tax world is complicated; navigating it requires a thorough grasp of the rules, regulations, and their effects, for which you need to extend research into what is the role of a tax advisory consultant. Tax advisors expertly traverse this maze, comprehending complex tax rules and turning them into effective solutions for their customers. These professionals are excellent resources for tax planning, compliance, and settling conflicts with tax authorities.

Risk Reduction and Compliance

It is critical to follow tax regulations. Failing to do so can have serious implications. Tax advising specialists are critical in ensuring that their customers comply with all legal duties while reducing risks. They methodically evaluate financial data, identify possible hazards, and develop risk-mitigation techniques to protect their customers from fines or legal troubles.

Making Strategic Decisions

Tax advice experts contribute considerably to strategic decision-making processes in addition to compliance. Their thoughts and analysis assist customers in making educated financial decisions that are in line with their goals. These specialists provide crucial guidance to maximize tax effects when restructuring corporate entities, mergers, acquisitions, or expansions.

Long-Term Relationship Development

A skilled tax advising expert is dedicated to developing long-term connections with their customers. These consultants become valued partners in their customers’ financial journeys by recognizing their individual needs, adapting to their financial progress, and providing continual support and assistance.

Conclusion

Understanding what is the role of a tax advisory consultant extends beyond simple compliance to include strategic advice, risk reduction, and bespoke solutions suited to each client’s specific scenario. They act as experts in the difficult realm of taxation, providing crucial assistance in navigating complexity while improving financial outcomes. Their impact goes well beyond statistics, improving the financial health and prosperity of the individuals they serve.