When Creating an Invoice Using Automated Sales Tax?

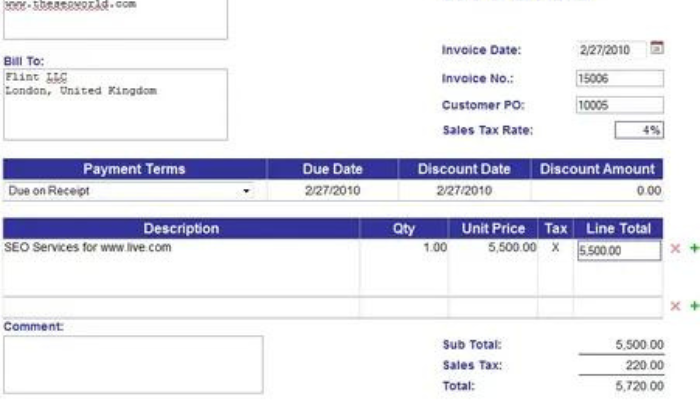

In today’s fast-paced corporate world, navigating the finances necessitates the demand for reliable tax advisor services. As technology advances, automated solutions have become essential for simplifying processes. When creating an invoice using automated sales tax, you must be aware that invoicing is one such sector that has undergone tremendous change, particularly with the inclusion of computerized sales tax.

Let’s look at the nuances that appear when creating an invoice using automated sales tax while preparing invoices and the benefits it provides.

Recognizing Automated Sales Tax

The complicated work of computing taxes on invoices is simplified by automated sales tax. It uses complex algorithms to calculate the exact tax rate applicable to each transaction depending on location, product type, and current tax legislation. This removes the need for manual computations, lowering mistakes and assuring tax compliance.

Simplicity of the Integration with Invoicing Systems

One of the primary benefits of when creating an invoice using automated sales tax is its easy integration into billing systems. This interface enables real-time tax computations, allowing businesses to issue proper invoices rapidly. Companies can save time and money by automating this procedure, which would otherwise be spent on human tax computations.

Increased Precision and Compliance

Manual tax computations are prone to inaccuracies, leading to invoice inconsistencies and compliance concerns. Sales tax automation reduces this risk by assuring correct tax estimates based on the most recent rules. This reduces mistakes and improves compliance with tax regulations, lowering the chance of penalties or audits.

Variable Tax Scenarios Customization

Businesses sometimes face various tax issues, ranging from differing tax rates in regions to exclusions for certain products or services. Customization possibilities for automated sales tax solutions address these issues. They may be designed to handle several tax rates and exemptions, allowing for more flexibility and accuracy in invoicing across multiple countries.

Record-Keeping and Reporting Efficiency

Automated sales tax solutions improve record-keeping and reporting in addition to streamlining invoicing. They keep extensive databases of tax rates and transaction details that may be quickly accessible for audits or reporting. This unified system assures financial record integrity and transparency, making tax filings and audits easier.

Savings in Both Money and Time

Businesses may greatly minimize the time and resources spent on human tax computations by automating the sales tax calculation process. This not only frees up workers to focus on more important activities, but it also results in long-term cost savings. Furthermore, the precision and efficiency provided by automation could minimize costly billing errors.

Last Thoughts

When creating an invoice using automated sales tax, knowing that it is a big step forward in streamlining firm financial processes is essential. Its capacity to simplify tax computations, assure accuracy, and improve compliance makes it a vital tool in today’s fast-paced corporate environment. By adopting automated sales tax solutions, businesses may streamline their invoicing operations, save time and costs, and remain ahead in an increasingly competitive market.

Integrating automated sales tax while preparing invoices is a strategic move toward ensuring accuracy, compliance, and cost-effectiveness in financial processes. As technology advances, adopting our best tax consultant Houston services must be a top priority for your esteemed organizations seeking efficiency and quality.

Read More:

What is the vat number for united states